Last Updated on July 14, 2022 by admin

Get GST Certificate Today – Online GST Registration Process

Friends , GST Certificate – Download GST Registration Certificate from online Today. If you are thinking to start a Business. Or already have a business and want to register GST number to get GST Certificate then you can contact us to get it quickly. We will provide you GST certificate within a day. You yourself can download GST Certificate from online after applying it online.

GST is an Indirect Tax called Goods and Services Tax. The GST has come into force in India from 1 July 2017 and has replaced most of the indirect taxes in India.

( Do You want GST Registration number and GST certificate Now within 1 day? Message us on WhatsApp no. +917896854741)

Read and Join : Best Telegram Channel For Intraday Trading

Apply GST Registration Certificate Online :

In today’s date, if a person wants to do any business related to goods and services. Then everyone except small and medium businesses will have to get GST registration compulsory. You must have a GST Certificate or GST Number. Without that a person or business cannot buy or sell goods or services.

In simple language, any person or organization that supplies or supplies goods and services. If his annual sales or turnover (40 lakhs / 20 lakhs in the North-Eastern states) exceeds the limit. He/ She will have to take GST registration and once registered, he/she will be required to follow all the rules under GST. Tax has to be paid. So first apply for a GST Registration number or GST certificate.

On the contrary, if he does not get GST registration certificate. He will not get the benefit of Input Tax Credit and he will also be deprived of many types of benefits and along with this, Penalty will be imposed on him for not getting GST registration.

Also Read :Tax Benefits

GST Registration Rules – GST Registration Rules :

There are some rules for GST Registration certificate

A. Mandatory Registration – Compulsory Registration

After understanding and knowing the GST, the most important question comes who should compulsorily register for GST and who does not. So the main basis for registration in GST is – Total Annual Sales / Annual Turnover of your business.

Starting from April 1, 2019, all businesses whose annual sales are more than 40 lakhs (20 lakhs in some north-eastern states) will have to be compulsorily registered under GST and follow the rules of GST. Here are some things to keep in mind in this new GST limit –

- The limit of 40 lakhs started from the financial year of April 1, 2019.

- This limit is applicable only on Sale of Goods, it is not applicable for services.

- This limit does not apply even when there is Inter State Supply.

- With this, the following will also have to take Mandatory GST Registration –

- Non Resident Indian (NRI)

- E-commerce agencies

- Entities supplying goods and services through e-commerce operators.

- Person eligible for TDS (TDS Deductor).

Read Also: MSME kya hai? MSME Registration

B. Voluntary Registration – Voluntary Registration ( GST Certificate)

Generally, if the annual sales of your business does not exceed 40 lakhs / 20 lakhs then you do not need to get GST registration. But even if it is not mandatory, if you want to get GST registration, then you can do voluntary registration.

It is important to note one thing that if you get GST registration certificate or GST register number once, after that you will have to follow the rules of GST like everyone else. Further, even if the annual sales of the business fall below the Threshold limit, there will be no difference. Along with this, the business also gets many benefits from voluntary GST registration. like –

- Benefits of Input Tax Credit.

- Interstate supply without any restrictions.

- Freedom to trade through e-commerce website.

- To be legally recognized as a supplier of goods and services.

Types of GST Registration for GST Certificate :

1. Regular – General Registration

For GST Certificate all the merchants who is a regular Dealer, normally supply goods and services and who do not apply under any particular scheme or basis (eg composition scheme or foreign NRI).

In simple words, in general, the business which supplies its Goods and Services does not do any other special activity. GST registration is done on the basis of regular dealer for such business or business. Traders can compulsorily or voluntarily get GST registration number or GST certificate done under this.

2. Composition Scheme – Composition Scheme (Simple Process for Small Businesses)

The Composition Scheme has been brought to small and fixed-selling businesses, so that the process of GST for small business is made easier. This is an option if the annual total sales of the traders is less than 1.5 crore, they can take GST registration under the composition scheme.

GST Rates in Composition Scheme : ( GST Certificate)

In composition scheme, GST has to be paid at low rates directly on the total sale of every quarter. Where the normal scheme normally charges 18% GST on the cell and gets the GST paid on Input Credit on the goods purchased. The same composition scheme charges tax directly at 1% or 5% on the cell and does not get Input credit Are,

- Trader or Manufacturer – 1% GST (0.5% CGST + 0.5% IGST).

- Restaurants – 5% GST (2.5% CGST + 2.5% IGST).

- Composition Scheme – Important Rules.

- They cannot claim for Input Credit.

- They have to pay GST on their turnover with a fixed rate.

- Up to 5 lakh services can be provided with the supply of Goods in a year.

- Traders cannot supply goods on which GST does not appear.

- Composition Dealer cannot do Inter-State Supply.

- Dealer will have to pay tax at normal rates under Reverse Charge Mechanism transaction.

- Where the business is going on, the merchant has to show that he is doing business under the Composition Scheme.

- Under composition scheme, the merchant cannot collect GST from his customer. He will have to pay GST from his pocket, hence he will have to issue a Bill of Supply instead of Tax Invoice.

- Payment of GST will include GST on supplies made, tax on reverse charge and purchase tax from unregistered dealer.

In this, the dealer has to do 4 Monthly Return File during the whole year. Which will be filled after every quarter and on the 18th of the following month. GSTR-4 has to be filed in quarterly returns, besides an annual return GSTR-9A has to be filed by 31 December of the next financial year.

Who Can apply Opt Composition Scheme – Who cannot take composition scheme

The following types of supply will not get its benefits under composition scheme –

Suppliers of any services other than restaurant related services.

Casual Taxable Person or Non-Resident Taxable Person.

Businesses supplying goods through e-commerce operators.

Manufacturers of ice cream, pan masala, or tobacco.

3. Foreign non-resident taxpayer –

Foreign Non Resident Taxpayer means a non-resident foreign taxpayer, which may include any person or company engaged in supplying taxable goods or services or both at any place in India by any means, but at a certain place of business. Is not A separate process of GST registration is made for them, which is completed by them.

4. Input service distributor –

Input Service Distributor (ISD) is a business that receives invoices for services used by its Branches. It distributes Input Tax Credit to all Branches where the trend of services was cut.

5. Tax Deductor.

6. E-commerce operator

7. Government department & UN bodies

Penalty for not getting GST registration – ( GST Certificate)

If GST registration is not done by the merchant or if merchant doesn’t have a GST Certificate even after coming under the preview of GST as per GST Rules or tax is not paid or less tax is paid, in such a situation the merchant will have to pay penalty – if found guilty according to GST Rules. Failure of non-payment of tax or payment of less tax will attract a penalty of 10,000 or 10% of the amount of tax payable, whichever is higher. In simple words, after filling the entire tax, a fine of Rs 10,000 will be paid.

Documents Required For GST Registration :

Different types of taxpayers will required the following documents for GST Registration certificate –

1. Individual / Sole Proprietorship

- PAN card.

- Aadhar card and photo of the person.

- Valid mobile number and email id

- Proof of Place of Business.

- Valid Bank Account Details.

2. Partnership / LLP

PAN card, Aadhar card and photo of all members.

Proof of Place of Business.

Valid Bank Account Details.

Having LLP – Copy of Board resolution & Registration Certificate of the LLP

Proof of appointment of authorized signatory- letter of authorization

3. Company

Company PAN Card. Registration Certificate of the company Memorandum of Association (MOA) and Articles of Association (AOA). PAN card, Aadhar card and photo of all Directors. Company Bank Details. Address Proof. Letter of authorization

4. HUF

HUF’s PAN Card. PAN Card, Aadhar Card and Photo of applicant. Address proof of place of business Own office / Rented office. Bank account information.

5. Society or Trust or Club

PAN Card of Society / Trust / Club. Their registration certificate. PAN card and photo of Promoter / Partners. Bank account information (copy of canceled Cheque or bank statement). Address Proof of Registered Office – (Own office / Rented office). Letter of authorization

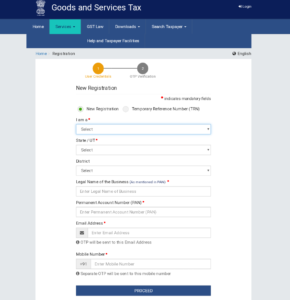

How to apply for GST registration – ( GST Certificate )

The entire process of GST registration to get GST certificate is online for which you should have the appropriate documents and you can do GST registration as per the information given below –

GST Registration Process :

1. First go to gst.gov.in/registration and login.

2. Now you have to fill Form A, in which you will have to give information about some information – PAN, Mobile Number and Email ID etc.

3. Then Verify by OTP. And get the application number.

4. Now fill the Form B by Application Number. In which upload documents according to your business.

5. During the next 3 working days, the officer can also ask for more documents during GST-REG-03. Which you have to confirm in GST – REG – 04.

6. If the officer does not agree, your GST Registration Application can be rejected, whose information will be given to you in GST-REG-05.

7. And if everything is correct, your GST registration application will be accepted and you are informed about it in GST-REG-06. This whole process may take up to 7 working days.

Easy GST Registration Process :

The process of GST registration is not so easy because it has to take care of many things like what kind of registration to take, what HSN code will be related to your products / services, what will be the Jurisdiction of your area etc. If you complete it If you do not know, then you should get your GST registration done with the help of Expert. Due to not having complete knowledge, you may have further problems and your registration may also be rejected. To make it easy, we have made a simple process for you, with the help of which it will be easy to get your GST Number –

You can contact us with your Mobile and Email ID and during this conversation our CAs and GST Experts will provide you complete information related to GST and Registration and will give proper advice.

In this, we will tell you which GST registration will be right for you, how you will have to maintain important records and accounts and how the GST Return will be filled on the basis of that.

After this, we will get the necessary documents and other information from you which will be required for GST registration.

After that you will have to pay our services charge online, which will be given to you. And

After making your payment, your GST registration will be done between a certain time period. So you can get GST Certificate.

Apart from this, Expert will give you complete information and provide important tools (like invoice format, GST Excel software) to make it easier to carry forward GST process like issuing correct invoices, keeping records, filing GST returns etc.

How to check GST registration – How to check GST registration status

[Application Status] –

1. First of all go to GST Portal.

2. In that, click on >>> Registration from >>> Track Application Status in Services.

3. After which you will have to enter the ANR (Application Reference Number) there and fill the CAPTCHA

4. Finally click on Search and your GST Reg. Application Status will be in front of you.

How to download GST Certificate ?

GST certificate Download process,

[Existing Status] –

1. First go to GST Portal.

2. Then click on >>> Search By GSTIN / UIN in Search Taxpayer.

3. After that you have to click on the icon of ‘Download’.

4. And your GST Certificate REG – 6 will be downloaded.

So this is how you can Download GST Certificate from online.

Conclusion :

So Friends, I hope all of you have got the basic ideas and solutions for GST registration and Gst Login. And How to Download GST certificate easily. So you can do it easily.

If you want to GST registration number and GST certificate within 1 day without any problem then you can contact us directly through our contact us section or in our WhatsApp No. we can provide you quickly. You just need to send your details and required documents to us. We will do the all Process.

And this is all simple process of GST Registration , To get

GST Certificate.

Contact Us Now .

[contact-form][contact-field label=”Name” type=”name” required=”true” /][contact-field label=”Email” type=”email” required=”true” /][contact-field label=”Website” type=”url” /][contact-field label=”Message” type=”textarea” /][/contact-form]

Like and share the post.

Thank You